What is EHOST?

EHOST stands for Equalized Homestead Option Sales and Use Tax. It is funded through a one-cent sales tax and provides property tax relief for eligible homeowners

Does DeKalb County have an EHOST program?

Yes. In November 2023, voters approved the renewal of the county’s EHOST program, which took effect in 2024 and will continue through 2030.

How does DeKalb County’s EHOST program work?

EHOST is a one-cent sales tax collected on purchases made in DeKalb County, excluding food and medicine. Revenue from this tax is used to provide property tax relief for eligible homeowners through homestead exemptions.

Who qualifies for DeKalb County’s EHOST program?

EHOST applies to all properties in DeKalb County that have an approved homestead exemption. To qualify, the property must be the owner’s legal residence for all purposes including filing of federal and state income taxes, registering any owned or leased vehicles, and registering to vote, as of January 1 each year. Only private residences are eligible for an exemption.

Once granted, the homestead exemption remains in effect until a new exemption is applied for and approved, or the property changes ownership. For more information about homestead exemptions and how to apply visit www.dekalbtax.org/exemptions.

Is the EHOST credit reflected on the property tax bill?

Yes. It is listed under the ‘EHOST Credit’ column, which shows the dollar amount of the EHOST credit for each eligible millage rate, deducted from the owner’s property taxes.

How is the amount of EHOST property tax relief determined?

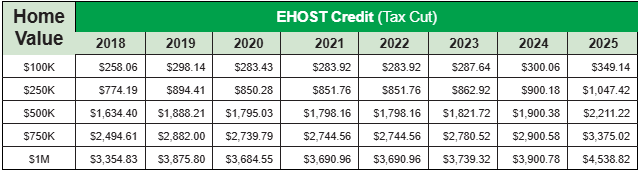

The amount of property tax relief varies based on home value, millage rates, and total revenue collected. Listed below is a historical comparison of the EHOST credit for various assessed home values, based on the adopted millage rate for each year: