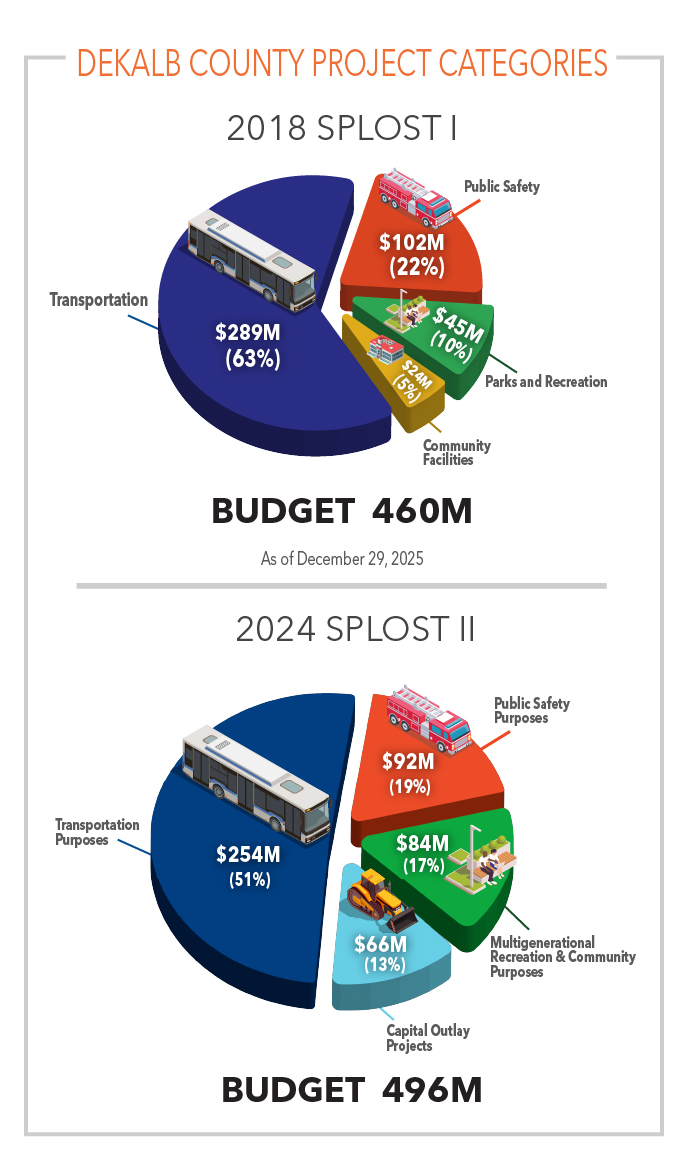

DeKalb County voters approved the county’s first-ever SPLOST in November 2017, and the collection of funds occurred from 2018 through March 2024. This six-year SPLOST required that 85% of the funds be dedicated to transportation and public safety projects, with the remaining 15% allocated to repairs and improvements of other existing capital outlay projects. SPLOST I generated approximately $460 million in revenue for unincorporated DeKalb County.

In November 2023, 72% of DeKalb County voters approved the SPLOST II referendum. Collection of funds began in April 2024 and will continue through March 2030. SPLOST II is expected to generate approximately $496 million for unincorporated DeKalb County.

SPLOST I and SPLOST II are projected to generate more than $950 million for unincorporated DeKalb County. DeKalb SPLOST represents a significant investment in the county’s future, improving quality of life for residents and creating stronger, more vibrant communities for generations to come.